BANKING SENTIMENT ANALYSIS APPLICATION & CASE STUDY

Is anybody really happy with their bank?

A South African bank dives deep into customer feedback to find out what their customers really like (and hate) about banking.

Start Your Free Trial

Banking

Understanding Banks, Net Promoter Score, and Sentiment Analysis

For financial institutions undergoing digital transformation, using sentiment analysis powered by artificial intelligence (AI) is essential to the successful marketing of financial products and services. The financial sector has witnessed incredible disruption over the last ten years. New challenger start-ups have entered the market armed with new digital financial products and platforms that threaten to re-imagine an industry that has become too complacent with legacy systems, antiquated thinking, and fossilized leadership.

This has forced banks and insurance companies to become more agile in their digital transformation by introducing automation powered by AI into various aspects of their business. Two of these areas are text mining and sentiment analysis. In this article, you will see a comprehensive customer case study that proves how Repustate's sentiment analysis API can boost business growth with powerful, data-backed insights. In addition, you can also get a preview of how sentiment analysis affects customer experience, and how it can increase a company's net promoter score.

Banking sentiment analysis case study

Customer Overview

The customer is a major bank based in Johannesburg, South Africa. It wanted a major overhaul of its services because the banking sector in South Africa is highly competitive.

Business Challenge

All major brands have comprehensive mobile banking offerings, attractive savings accounts, and innovative products with which to win demand deposits. Churn rates tend to be high, with banks making attractive offers to win customers over from rivals. The customer wanted to ensure that it was a step ahead of its competitors, and was doing everything possible to keep operational efficiency and customer service at the highest level possible.

Technical Solution

Repustate began with gathering as much feedback from existing and potential customers as possible. A social media listening campaign was started using a hashtag on Twitter and Facebook to get people to say what they didn't like about their current bank. Over a 90 day period, the bank gathered over 2 million pieces of text. Some short form, such as those on Twitter, and some longer as you'd expect on a Facebook comment.

Steps in aspect-based sentiment analysis

Repustate developed custom categorizations, wherein categories were created with which to break up responses into semantically similar areas. For example, comments about mobile banking were put into one bucket, fees and charges another, branch banking another bucket, and so on. In total, Repustate discovered 7 categories that were relevant.

Using named entity recognitionthe text was classified as belonging to one (or more) of the categories, sentiment was applied as well as keyword extraction to determine the true intent of the comment. This is best illustrated with an example:

“I really hate going to my branch during lunch time and seeing only 2 tellers with a huge lineup. Why do they go to lunch all at the same time?”

Repustate's would categorize this as belonging to the "Brach banking" category, and then applied sentiment. The raw sentiment score for this text would be < 0, indicating negative sentiment.

Insights Reporting

With the initial round of analysis complete, it was time to aggregate the results into a sentiment visualization dashboard to see what Repustate's text analytics uncovered.

Positive (%) Negative (%)

The sentiment for each category was graphed as percentages e.g. of all the complaints about Mobile banking, 54% were negative, 46% were positive.

Taking a look at the graph, phone support, online banking (the bank's website) and branch banks were the biggest sources of negative comments. Performing a keyword/ key-phrase analysis on the comments revealed some insight as well. As an example, here were the most common phrases under the "Branch" category:

- "long lineups"

- "always closed" (referring to the hours of operation)

- "no tellers"

Business Benefits

With this phrase analysis combined with one simple chart made possible by Repustate's text mining capabilities, the bank now knew exactly where to focus its efforts to become the bank known for its customer service. A major overhaul of the bank's website was initiated to make it easier to understand one's own products, obtain information about balances and payments, and get information about new products.

Branch banks were overhauled to ensure teller staff always could meet up with surges in customer traffic, notably lunchtime and just after the workday. Particularly heavy traffic areas (e.g. downtown core of Johannesburg) were left open 1 hour later to accommodate customers.

Follow-up Report - Measuring KPIs

As with any new initiative, you have to measure the change to see if it was worth the trouble. While the bank did experience growth in customers and a reduction in churn, the most telling numbers came from a similar campaign that was run 6 months later. Same questions, same process. This time, just under 1 million responses came in via text and social media. Repustate applied the same methodology as last time.

Positive (%) Negative (%)

The two areas the bank put a big focus on, branch banking and the online experience, experienced large swings in sentiment. Branch banking actually had a positive sentiment score, which is pretty outstanding. Clearly, more work had to be done, but the bank felt it had turned a corner in altering people's perception of what a bank should be.

How can Repustate help banks like you?

By extracting high relevance information from unstructured data, Sentiment analysis can help banks, do the following:

- Understand customer journey

- Improve branch and online experience

- Create better, more personalized products

- Empower bank employees to drive change

- Make innovation a part of the corporate culture

Repustate can help you quickly and accurately extract high-relevance information from your unstructured data. Then turn them into data-driven insights that can inform strategy for positive Customer Experience change.

Like all of Repustate's products, multilingual sentiment analysis is supported in over 23 languages including English, Spanish, French, and Arabic.

How can banks improve Customer Experience (CX)?

Customer experience (CX) is a marketing term that refers to a customer's holistic view of a company's overall brand. It's based on their various encounters with the company across multiple points such as products, branches, online, mobile, and customer service. CX can be complex as each customer has their own unique, dynamic experience that is the result of multiple brand impressions formed through first-hand encounters.

In this ever-competitive world, t does not take much for customers to turn on their banks and begin looking for alternative financial brands to switch to. Bank customers are expensive to acquire and have a substantial lifetime customer value, so losing a bank client can be costly. If banks can service their customers better, and personalize financial offerings to their specific needs, churn rates will be considerably lower.

FFor the financial sector to be more customer-centric, as opposed to product-centric, they need to listen to their customers and know how they feel about various aspects of their business such as fees, customer service, product quality, online banking, etc. This allows for their marketing and promotion to be more data-driven and confident in acquiring and retaining high-value customers. This is where voice of the customer comes into play.

Establishing an accurate voice of the customer (VoC) by listening for and gathering customer insights across various touchpoints can be a daunting task if it is not automated using tools that are both fast and accurate. This is where sentiment analysis can be an excellent complement to other customer and brand metrics such as Net Promoter Score, the golden measure of all KPIs for the banking, insurance, and investment sectors. We talk about this in detail, a bit later.

Many financial institutions have implemented marketing technology stacks to reduce or eliminate tedious manual tasks, scale more quickly, measure campaign effectiveness, and drive more cost-effective results. Sentiment analysis, the identification and classification of customer sentiment in text, has also become automated. Natural language processing (NLP) and machine learning applied to text analytics increase accuracy, speed, and overall efficiency. When a more granular level of emotion analysis is applied through aspect-based sentiment analysis, the insights are even more detailed and powerful.

This has made it easier and faster for financial institutions to understand their customers, improve the net promoter scores, and enhance the customer experience across their branches, online banking, mobile app, and call centers.

How can Aspect Based Sentiment help Bank CX?

Sentiment analysis consists of the identification, extraction and scoring or consumer feelings and opinions as they appear in social media, customer surveys, emails, client reviews, etc. Sentiment analysis tells you whether the content of a piece of text data is positive, negative or neutral.

Aspect based sentiment analysis goes one step further than typical sentiment analysis by automatically assigning sentiment to predefined categories. It involves breaking down text into smaller chunks, allowing more granular and accurate insights from data. With aspect based sentiment analysis, it can be distinguished which features of a bank's customer experience are liked and which ones can be improved.

In typical reviews, consumers often touch on many aspects of customer experience. Complaints or praise for online banking, branch line-ups, all be mentioned in one comment. Sentiment analysis at aspect level first determines which categories are being mentioned and then calculates the sentiment for each of those categories. When compiled in aggregate across a large number of reviews, the strengths and weaknesses of a business' customer experience surface quickly and actionable insights become obvious instantly.

For example, the banking sector in South Africa is highly competitive. All major brands have comprehensive mobile banking offerings, attractive savings accounts, and innovative products with which to win demand deposits. Churn rates tend to be high, with banks making attractive offers to win customers over from rivals.

What is Net Promoter Score in Banking?

Net Promoter Score or NPS is a key performance indicator or metric used in customer experience programs. The ultimate aim of NPS is to measure the loyalty of customers to a company.

The idea of developing one simple metric or key performance indicator for customer experience was first put forth by best-selling author, speaker, and business strategist Fred Reichheld in 1993. It was later built upon by consultancy firm Bain & Company and Satmetrix as a way to predict customer purchase and referral behavior.

At the core of the NPS sits the ideas of customer loyalty, and the power of client referrals to drive new customer acquisitions. If one of your present clients has had really positive customer experiences with your brand, they are more inclined to promote you to their friends and family through word of mouth, social media, or reviews. This is not only free marketing, it is also the most authentic, trusted, and effective form of promotion, because consumers trust other consumers most.

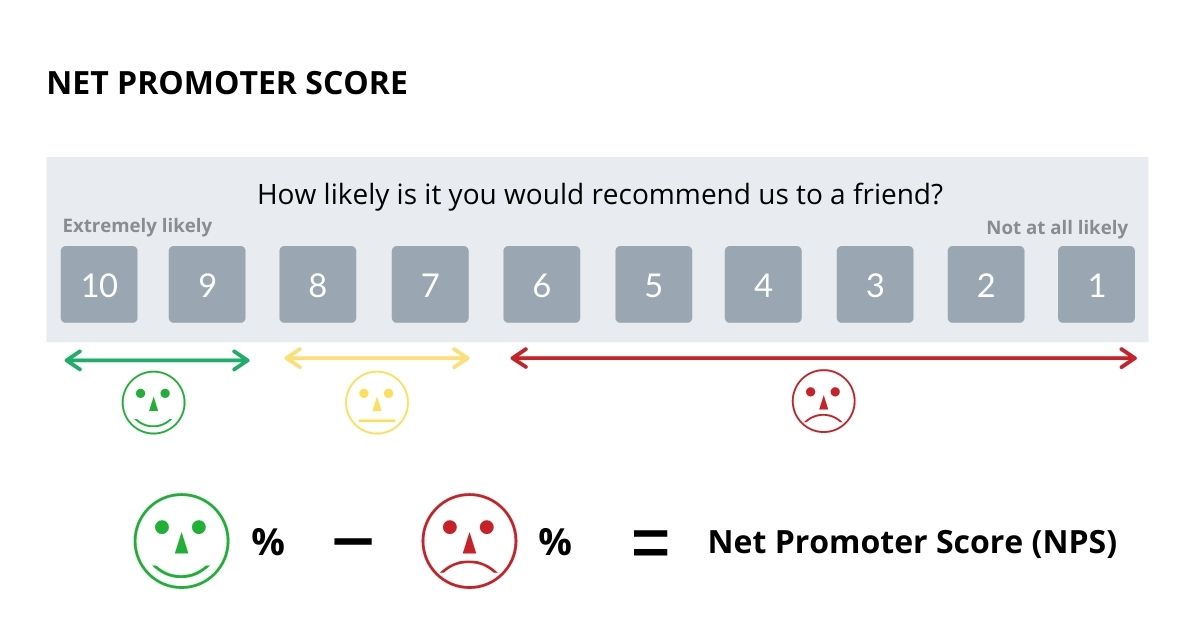

NPS evaluations are determined with a single-question survey and reported with a number from -100 (very unloyal and prone to switch) to +100 )very loyal with a high propensity to promote. This metric measures customer experience based on one simple question: How likely is it that you would recommend - Bank X/Financial Product Y/Insurance Service Z - to a friend or colleague?

Respondents give a rating between 0 (not at all likely) and 10 (extremely likely) and, depending on their response, customers fall into one of 3 categories to establish an NPS score: Promoters respond with a score of 9 or 10 and are typically loyal and enthusiastic customers. Passives respond with a score of 7 or 8. They are satisfied but not enough to openly promote your brand.

Detractors give a score of 0 to 6. These are unhappy to very unhappy customers who are highly unlikely to buy from you again, and may even dissuade others from buying from you. NPS results are reported with a number from -100 to +100, a higher score is desirable.

Thus, your Net Promoter Score is calculated by taking the percentage of promoters minus the percentage of detractors.

Although the NPS is a simple, clean metric for customer loyalty, it analytically falls short in providing banks, investment firms, and insurance companies enough direction when looking to improve loyalty and customer experience. It does not provide any insights as to the specific aspects of customer experience that require the most attention or can provide the greatest return on the investment of budget and resources. In short, NPS does not give enough details on what specifically is right or wrong with a financial institution's CX, nor does it begin to direct companies toward possible solutions. That is why you need sentiment analysis.

How can Sentiment Analysis help Net Promoter Scores?

Text analytics and sentiment analysis can help the financial sector by providing NPS with additional, complementary data analysis that can begin to fill in the “why” and “how” of CX change. Sentiment analysis can analyze text for expressed customer feelings in social media, surveys, forums, and blogs. At the cornerstone of customer experience lies consumer conversations that banks must listen to in order to discover vital, granular insights. The challenge is to go through multiple sources of customer data while extracting the most relevant information that can shine a brighter light on various parts of CX.